Objectives

- Add Taxes

- Enable Taxes on Invoices

Steps

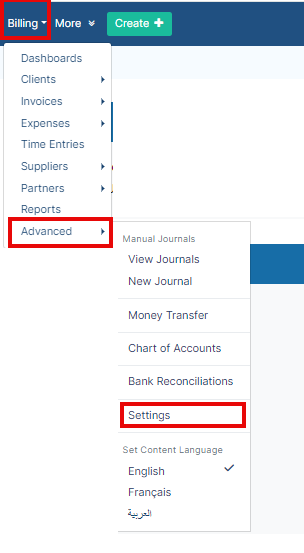

In LEXZUR, you can set Taxes on Invoices. First, go to the Billing Module, from the advanced press on Settings.

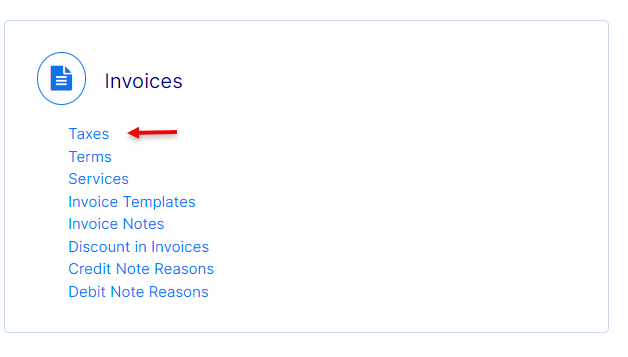

Under Invoices, click on Taxes.

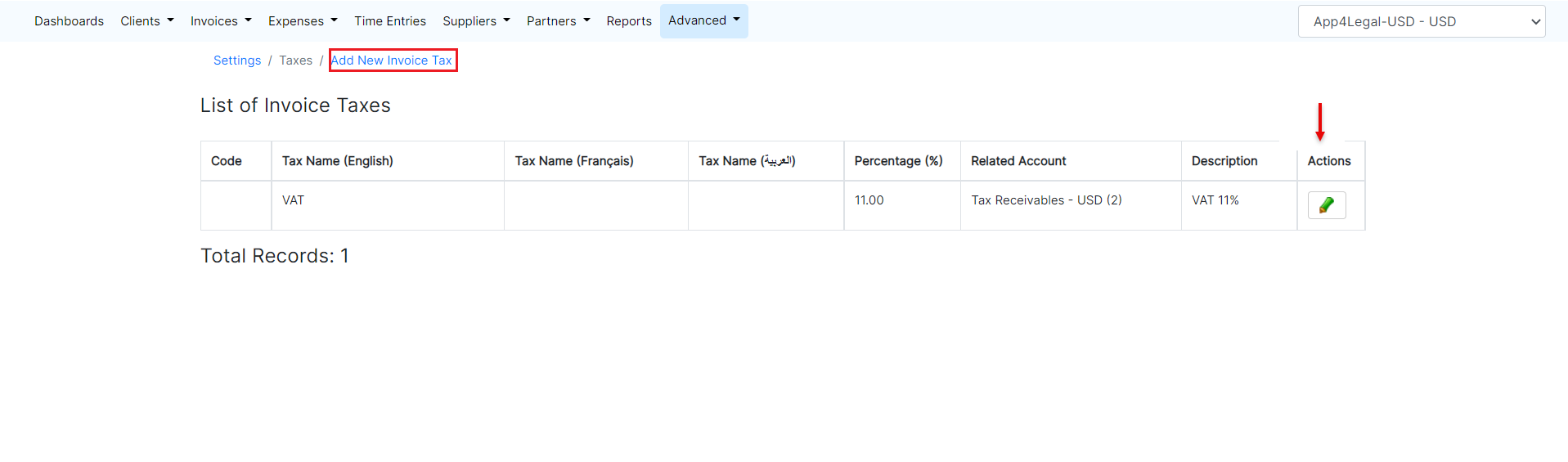

From this page, you can view the invoice taxes list, edit them, or add a new one.

You can add a new Tax by clicking on the Add New Invoice Tax hyperlink.

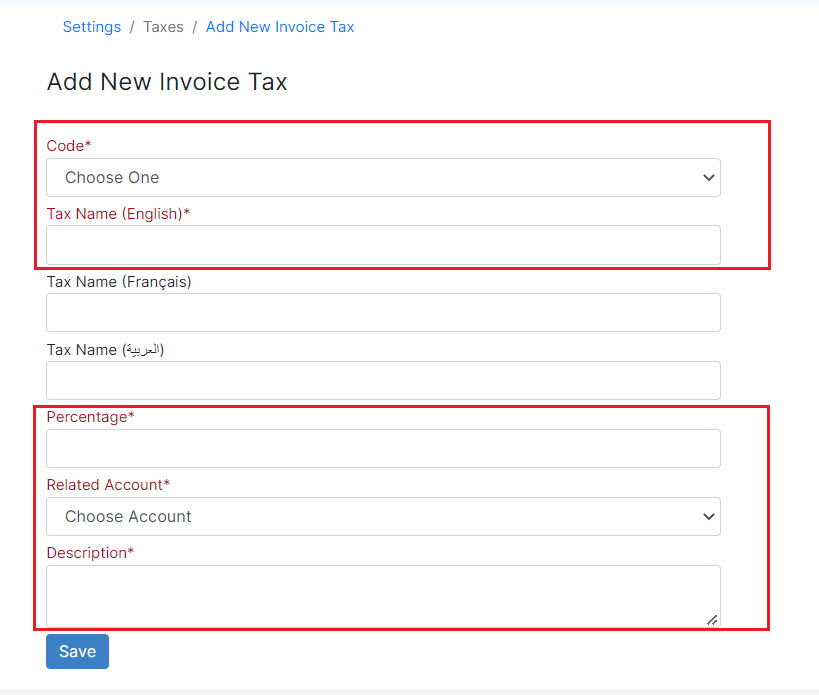

There are 5 mandatory fields to be filled:

- Code: either a Standard Rate or Zero-rated goods

According to ZATCA, Standard Rated includes all the taxable supplies with the application of VAT in each emirate, and Zero-rated supplies include supplies with VAT tax rated at zero percent.

Countries designate products as zero-rated because they are leading contributors to other manufactured goods and a significant component of a broader supply chain.

- Tax Name

- Percentage

- Related Accounts: relate this tax to a receivable or payable account

- Description

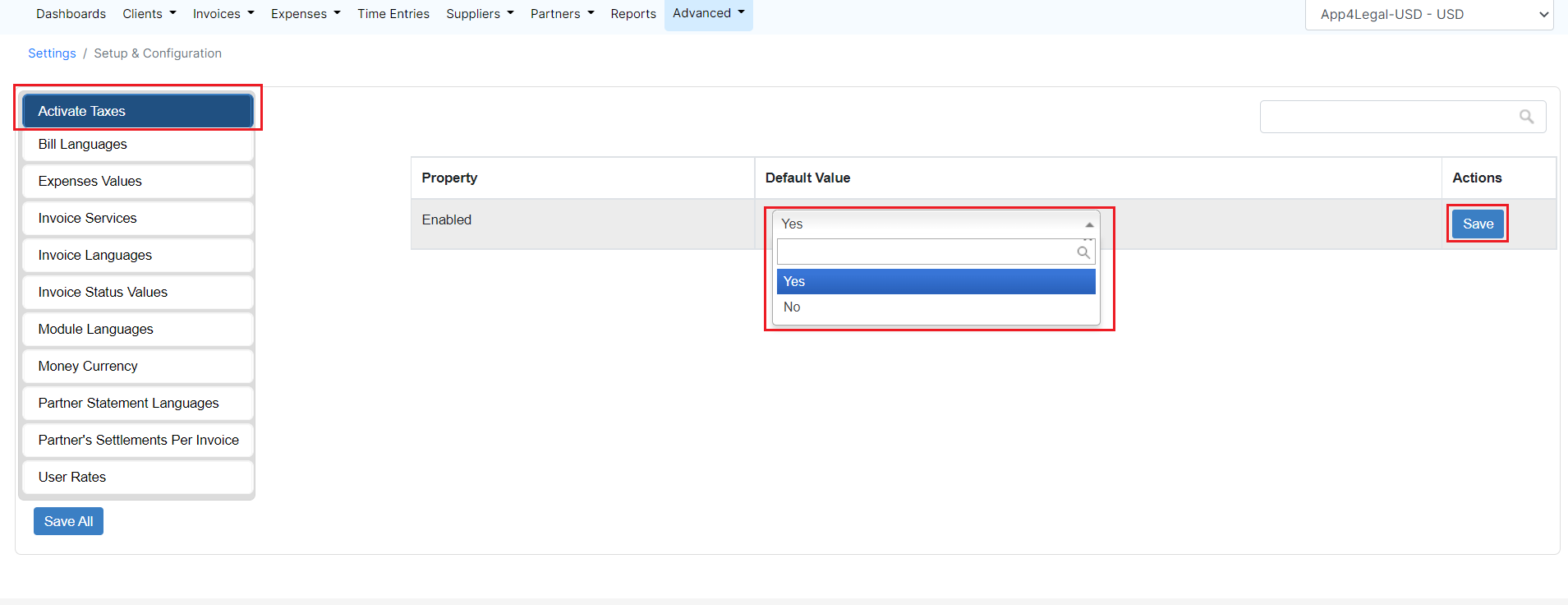

However, in order to enable taxes on invoices, a user should go to the Setup and Configuration settings, and from the Activate Taxes tab enable the taxes.

For more information about LEXZUR, kindly reach out to us at help@lexzur.com.

Thank you!

This page has no comments.