Objectives

Steps

To add a new expense, you can either choose "Expense" from the quick Create button or from the separate Expenses Tab on the matter page.

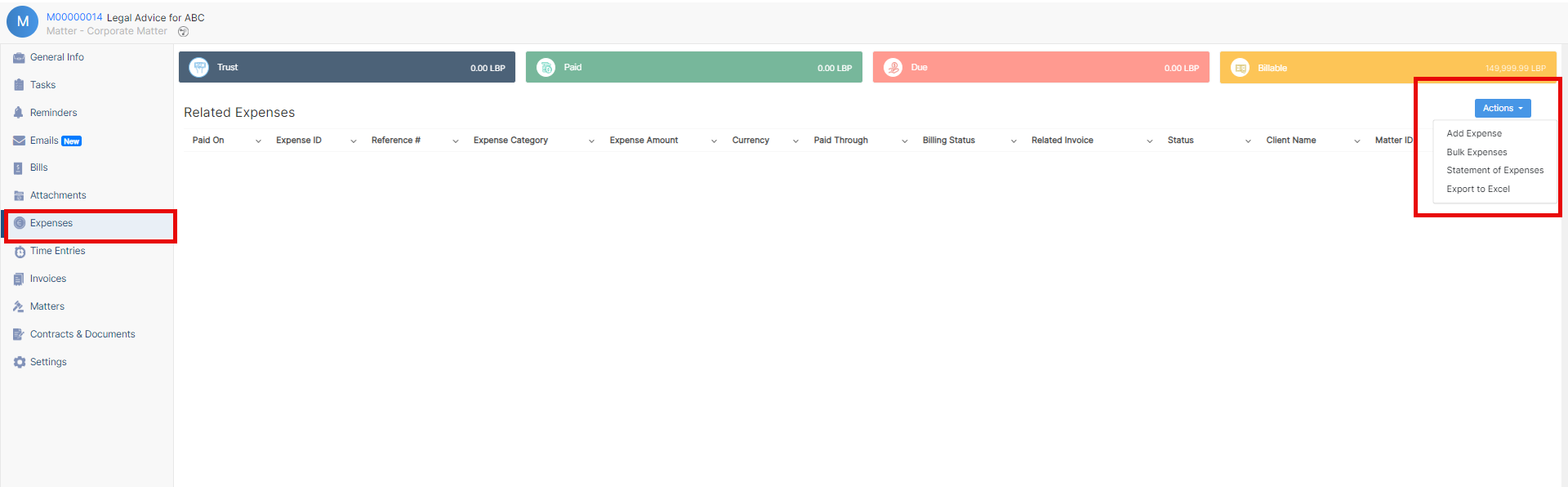

Therefore, open the Matters page, then navigate to the Expenses tab, and click on the Actions button to record a new related expense or bulk expenses.

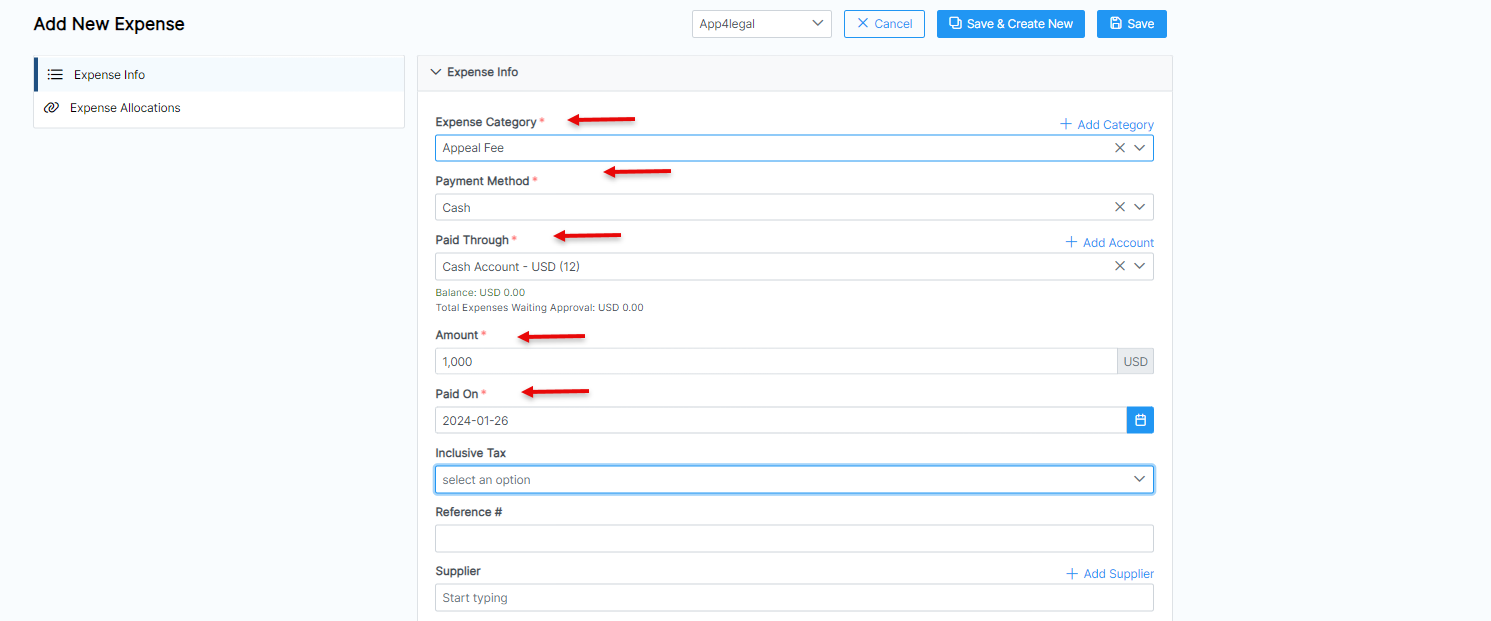

Fill out the following mandatory fields:

- Expense Category: choose from a list of customized categories such as court fees, expert fees, office supplies, and so on.

- Payment Method: This determines the types of accounts that appear accordingly, such as Cash Accounts, Credit cards, Bank Accounts, and so on.

- Paid Through Account: The Accounts that appear as per the Payment Method selected. Accounts can be also added on the fly.

You can add different types of accounts including Cash, Bank, and Credit Cards, and add the necessary account details. - Add the Amount to be paid

- And specify the Date by which the payment should be received.

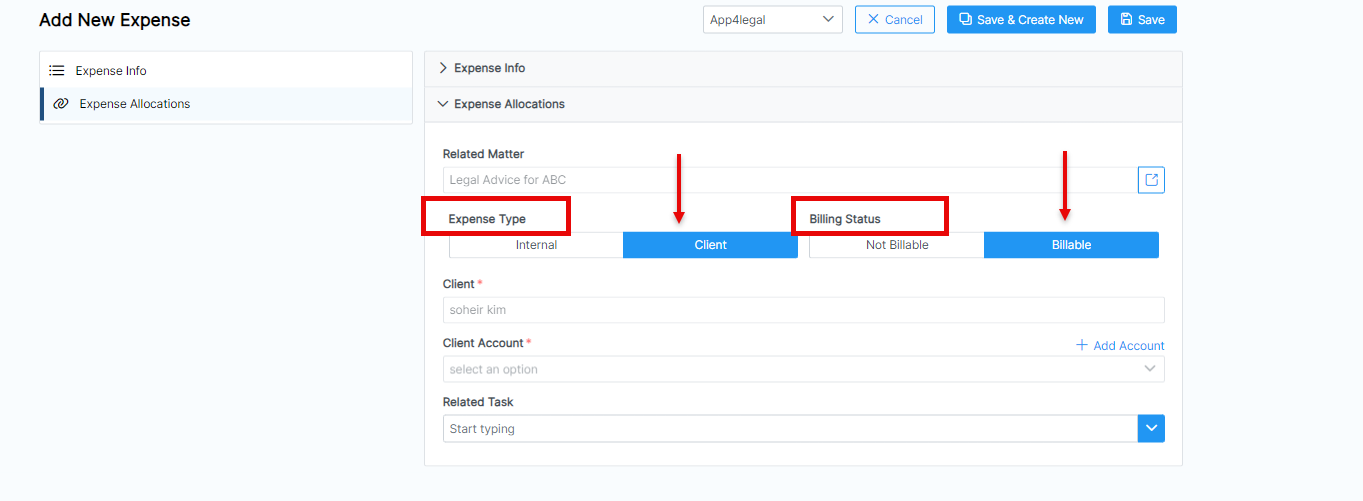

Additionally, you can link this expense to matters, tasks, and hearings, as well as specify if it's an internal expense or recorded on a client account.

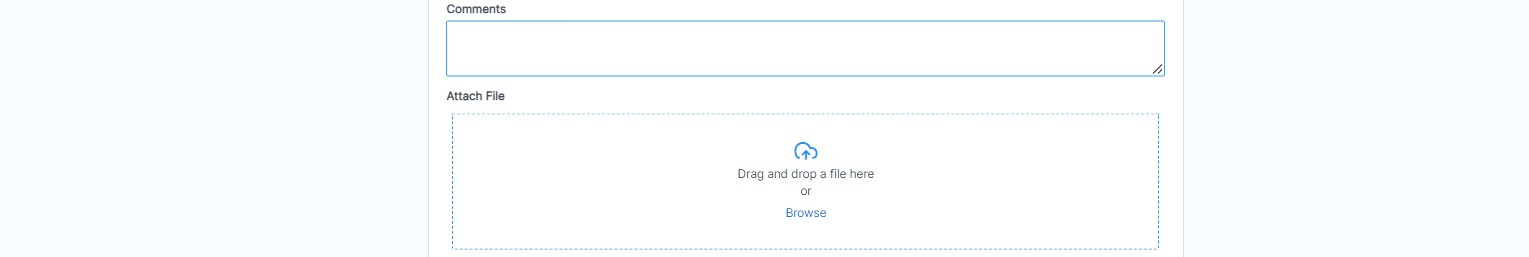

However, client-related expenses may be billable or nonbillable, so be sure to indicate accordingly, and attach any related documents to the expense as well.

To add Bulk Expenses click on Action→ Bulk Expenses from the Matter's expenses page.

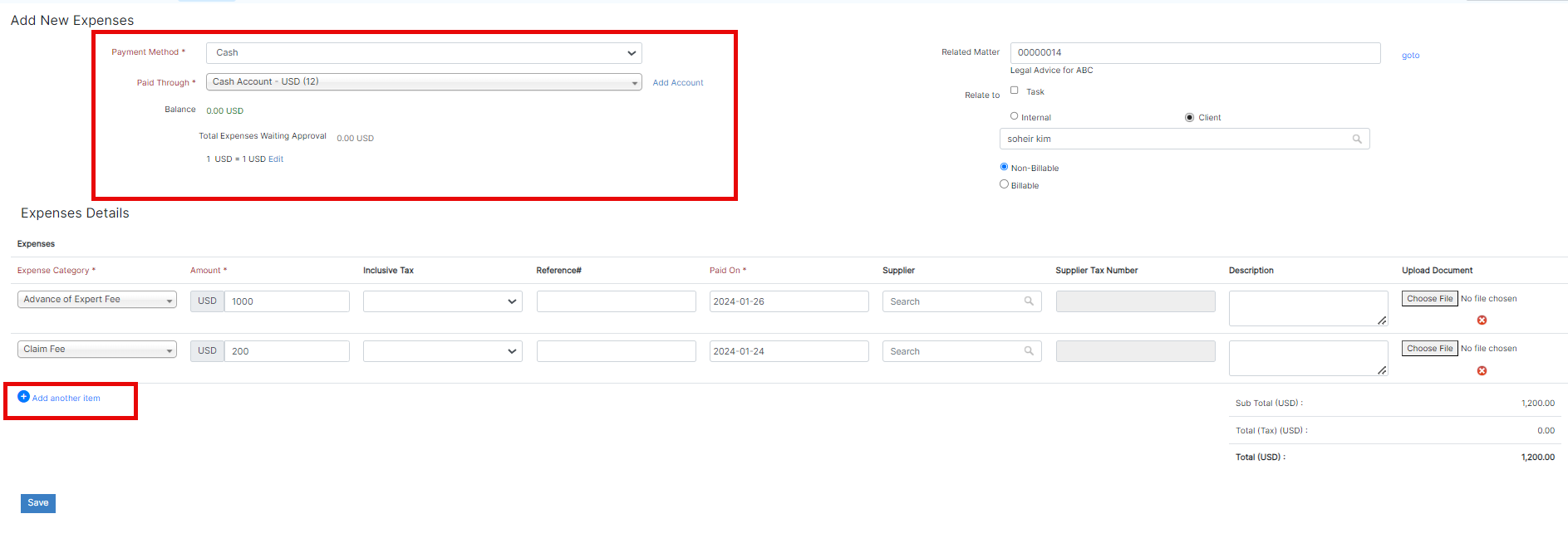

Select the payment method and the account through which the payment is made. Additionally, you can associate them with matters, tasks, or hearings, specifying whether they are internal or client-related, and choose the billable type.

In the Expense details section, enter the expense items on separate lines. Provide the category, amount, tax information, paid-on date, and other relevant details.

Once you record all the expenses related to a Corporate Matter or a Litigation Case, you can preview them in the grid.

Also, you have the option to view the statement of expense report and export them into a spreadsheet for other reporting purposes.

For more information about LEXZUR, kindly reach out to us at help@lexzur.com.

Thank you!

This page has no comments.