Objectives

- Bank Reconciliation feature

Steps

Bank reconciliation is the process of matching the bank balances reflected in the cash book of a business with the balances reflected in the business's bank statement in a given period. Such a process determines the differences between the cash book and bank passbook balances.

Reconciling bank statements with cash book balances helps you, as a business, to know the underlying causes that lead to such differences. Once the underlying cause of the difference between the cash book balance and the passbook balance is determined, you can make the necessary corrections in your books of accounts to ensure accuracy.

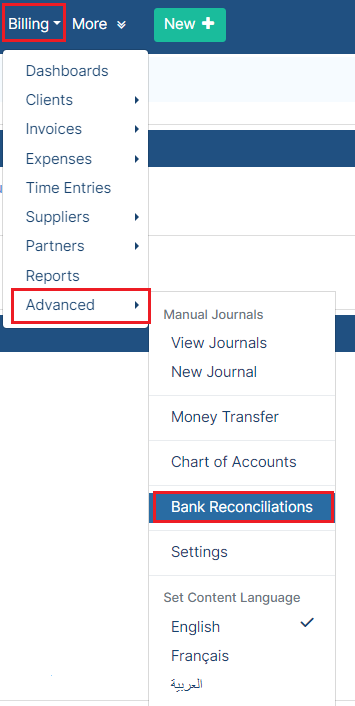

The first step is to click Billing→ Advanced→ Bank Reconciliations from the main menu.

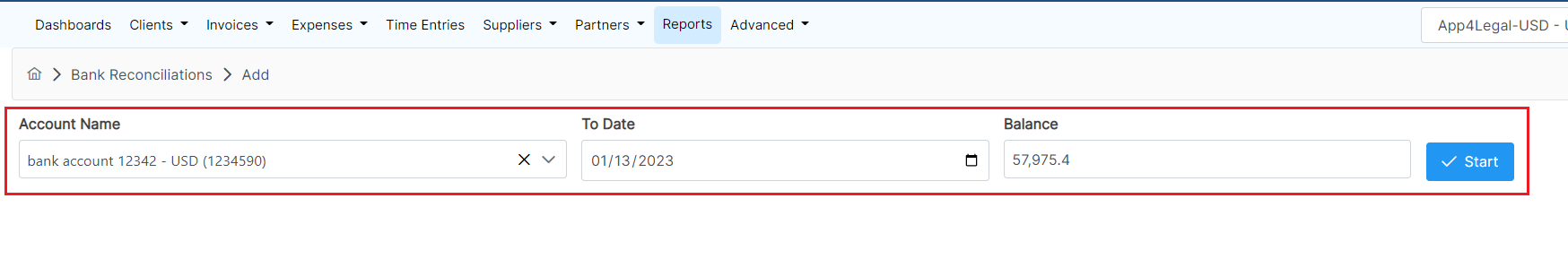

To set the balance/date that is in the bank statement they got from the bank, you must select the account name, the "to date" and the balance.

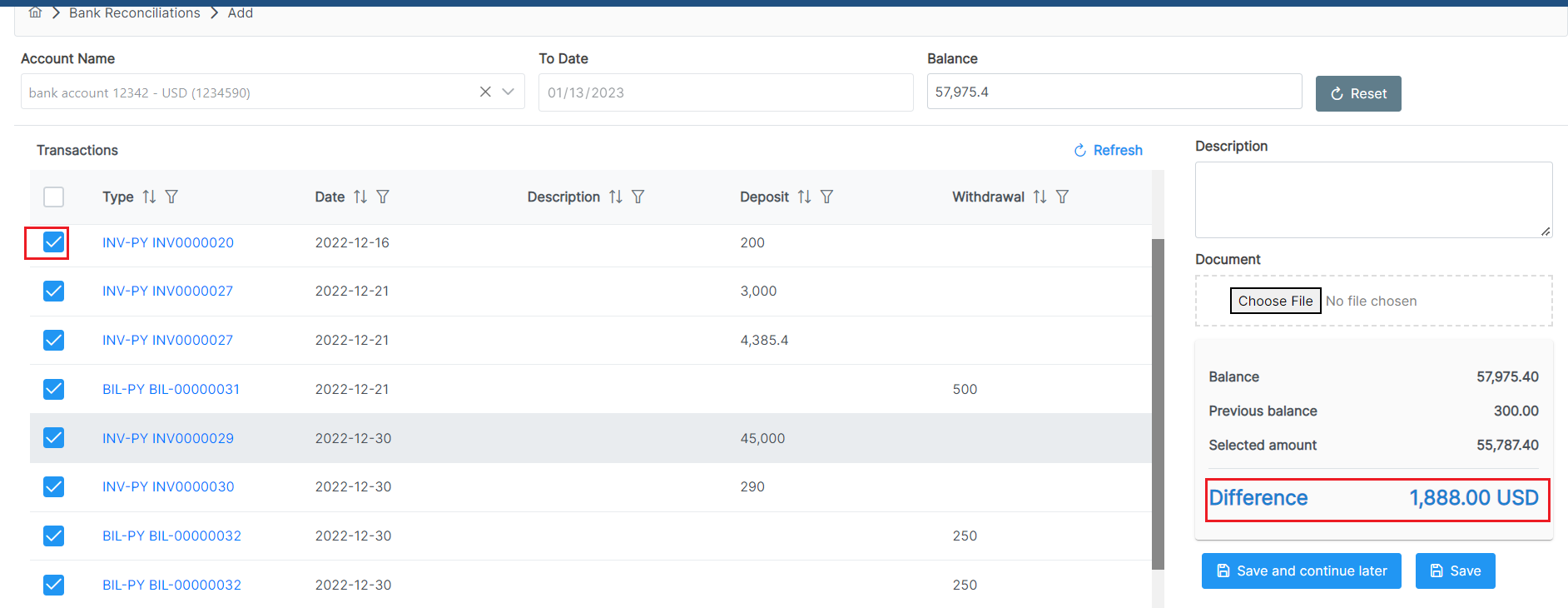

Click on the checkbox to select the transactions that match with the bank statement transactions. After you finish all the transactions, you can check if there is a difference.

Click on save and continue later if you need to make more changes, and save when you're done.

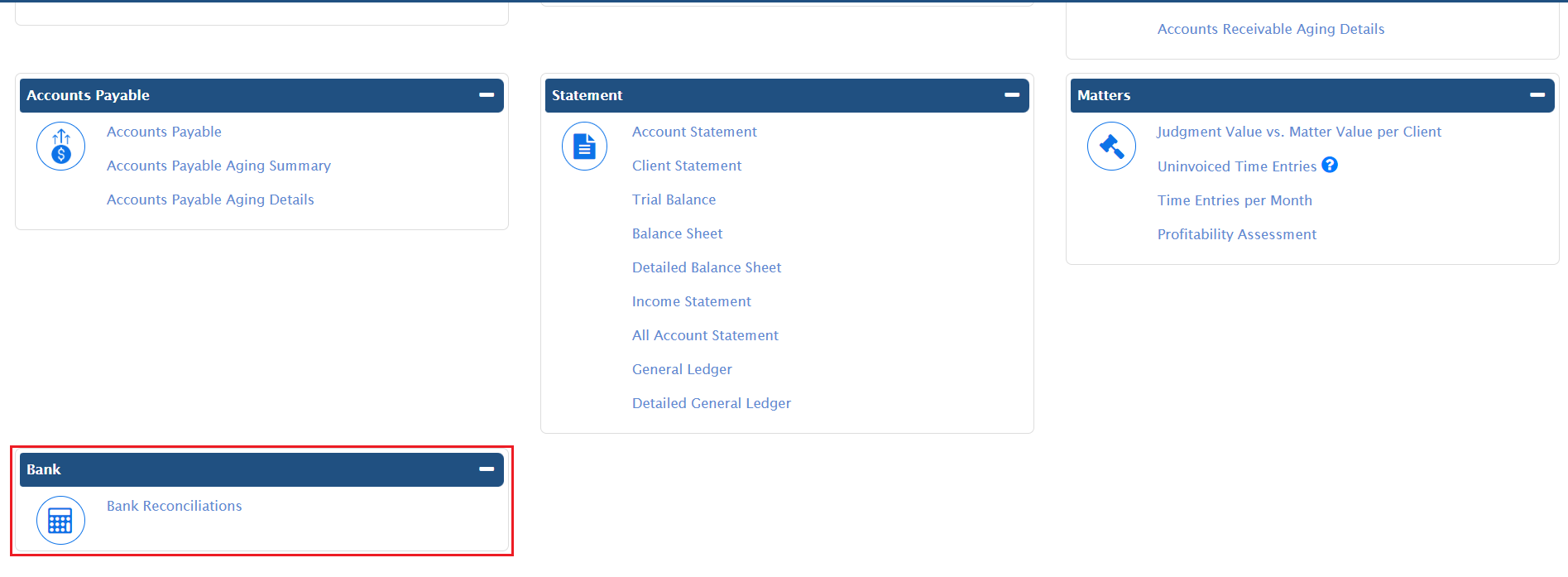

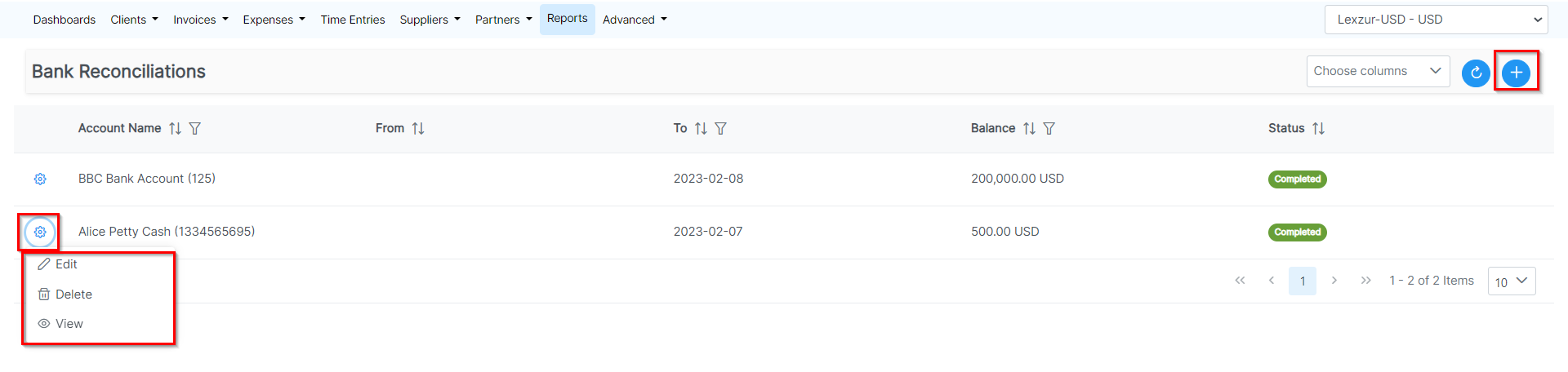

Click on the Reports → Bank reconciliations to be able to access all the reconciliations in one single report with their statuses, balances, and dates.

You can edit, delete, or view any previous record.

The first time you tried to add a bank reconciliation to an account, if your bank statement is not accurately reflected by the transactions shown, it can be fixed by adding a new journal.

For more information about LEXZUR, kindly reach out to us at help@lexzur.com.

Thank you!

This page has no comments.